Personal loans made for everyone

Comparison rates from as low as 7.06% p.a.*

56,000+ people trust SocietyOne

The SocietyOne difference

Personalised rates

Personalised rates

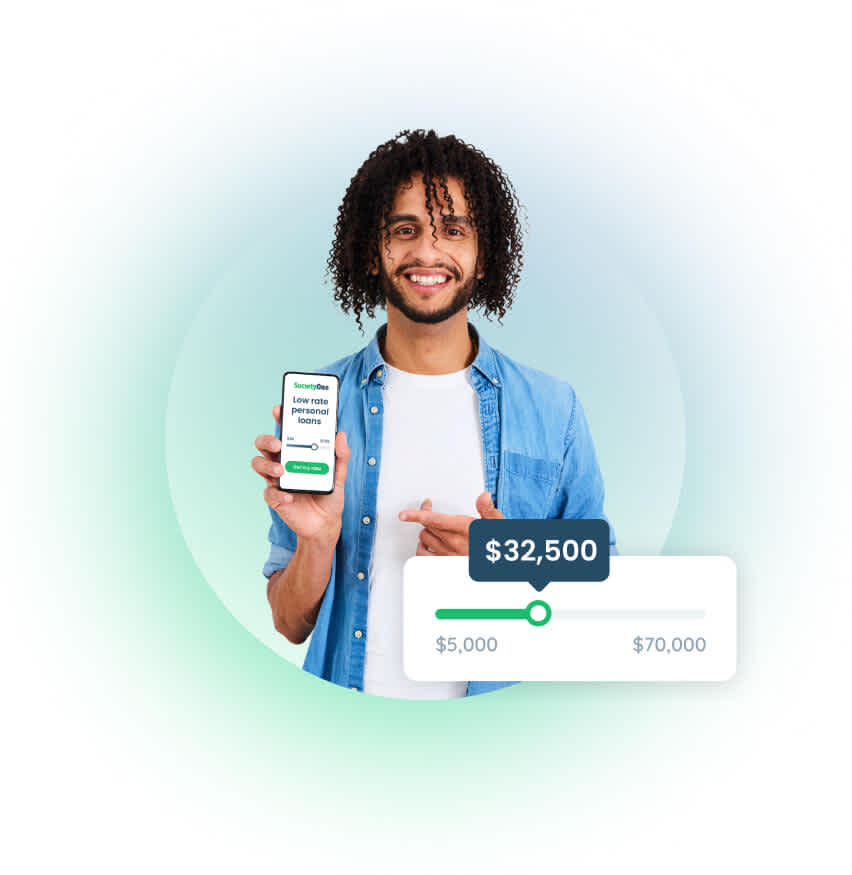

Our rates are based on your unique credit history, so you get a deal tailored to you. Borrow as little as $5,000 or as much as $70,000.

Flexible options

Flexible options

Choose between secured or unsecured loan options, terms up to 7 years and monthly or fortnightly repayments.

Easy application

Easy application

Our application process is 100% online. Apply in as little as 5 minutes and once approved, have the funds in your account as soon as 1 business day.

No monthly or early repayment fees

No monthly or early repayment fees

We’re always up front with our pricing. We don’t charge ongoing fees or have any penalties for paying off your personal loan early.

How it works

Get your personal loan in 3 easy steps

Get your rate

Find out your rate in 2 minutes based on your unique credit history.

Apply online

It only takes 5 minutes for most people to complete their online application.

Get your funds, fast!

Once approved, you’ll have the funds in as little as 1 business day.

Get your rate

Find out your rate in 2 minutes based on your unique credit history.

Apply online

It only takes 5 minutes for most people to complete their online application.

Get your funds, fast!

Once approved, you’ll have the funds in as little as 1 business day.

Secured vs unsecured

We offer both secured and unsecured loans depending on your needs.

Loan calculator

Choose your loan amount and see what your repayments will be.

How we compare

See how our rates compare against the big banks

Don't just take our word for it...

At SocietyOne, we understand the diverse financial needs of Australians across the nation. If you're after personal loans Sydney locals trust, we're the leading digital finance platform to consider. Dreaming of a beachside home renovation near Surfers Paradise or South Bank Parklands? No wonder you’ve been endlessly looking up terms like ‘personal loans Gold Coast’ and ‘personal loans Brisbane’. Well, your search finally ends here. At SocietyOne, you can access secured and unsecured loan options conveniently online. Even couples dreaming of a grand wedding near Federation Square have put their search for ‘personal loans Melbourne’ to rest after discovering us. Whether you’ve been looking for personal loans Adelaide-wide or going through the personal loans Perth has to offer, we know that you have big plans for your future. But you don’t have to rely on the limited selection of personal loans Hobart locals recommend or the personal loans Canberra dwellers swear by anymore. We are the home of a faster and fairer deal. So, whether you’re in search of personal loans Darwin-wide or wherever you may be in Australia, know that we can help with your personal loan and debt consolidation needs.

Frequently Asked Questions

Things to consider before getting a personal loan.

How are interest rates calculated, and what is the current interest rate?

Calculating interest rates may seem as intricate as alchemy, but at SocietyOne, we strive to simplify this for our valued customers. Our approachable and empathetic approach makes borrowing less intimidating and more accessible to all. With this, we calculate interest rates carefully – a unique process from one person to the next.

Interest rates, rather than being arbitrarily set, are meticulously personalised for each customer. We believe in fairness; hence, the rates are determined based on specific factors such as your credit score.

The rule of thumb is that the better your credit profile, the lower your interest rate. This means you could be presented with a more favourable deal than many traditional banks. Ultimately, our commitment to risk-based pricing is a testament to our philosophy of fairness and understanding.

Now, you might be curious about your current interest rate. Not to worry, we’ve got you covered with a quick and easy procedure. Simply visit our Rates & Fees page here at SocietyOne to discover your interest rate. We are here to guide you throughout your financial journey, ensuring transparency and trust at every step.

At SocietyOne, we don’t shy away from positively educating our customers. That’s why we want you to know that a secured loan is a type of credit that is backed by an asset, such as a car. So what does this mean for you? It opens up the opportunity to borrow more funds at lower interest rates and for a longer period of time.

These benefits are due to the reduced risk for us, the lender, allowing us to pass the advantage onto you, our customers. Moreover, our range of secured loans spans from $5,000 to a substantial $70,000 over two, three, five, or seven years, offering flexibility tailored to your needs.

It’s important to understand that at SocietyOne, we realise you might not wake up looking for a personal loan. But with the joys of life just around the corner, exciting projects can pop up or a new car could be calling. In this case, a personal loan could be the helping hand you need to make your aspirations a reality.

Whether it’s for home renovations or a week-long holiday trip with friends and family, we aim to make your financial experience smoother and more manageable with personal loans.

As a leading Australian lender, we at SocietyOne thrive on simplifying your financial matters, giving you a faster, fairer deal, and making your dreams come true. Our customers are at the heart of all we do, and their trust fuels our dedication.

What are early repayment fees?

Early repayment fees, often known as prepayment penalties, are charges levied by some lenders on borrowers who pay off all or part of their loans ahead of the agreed schedule. These fees are detailed in the loan contracts and are permitted on certain loan types like personal loans, mortgages, investment property advances, and lines of credit.

In some cases, these penalties may not apply if you make additional repayments on your loan in small amounts at a time. Many early repayment terms contain agreements allowing borrowers to pay off a certain portion of their loan without incurring a fee. Additionally, the calculation of this fee typically factors in the overall repayment sum, interest rates, and what you’ve already paid.

Unlike other digital and traditional lenders, we at SocietyOne believe in empowering you to take control of your finances without the fear of unexpected charges. For this reason, we offer a straightforward, transparent fee structure with absolutely no early repayment fees. In line with this, we also don’t have any monthly fees, and we have a one-off establishment fee included in your total loan amount.

As such, you get the assurance of a fixed-rate loan coupled with the flexibility to pay it off early at SocietyOne. This means we provide the financial confidence that is often missing from conventional lending, combined with the freedom to manage personal loans on your terms.

Being Australia’s leading digital finance platform, we pride ourselves on our ability to simplify complex financial processes and make them accessible to everyone. We offer two types of personal loan products: unsecured and secured loans, allowing you to borrow between $5,000 and $70,000, depending on the type of loan, over varying periods.

Our ultimate goal is to make the application process for personal loans as smooth as possible with a fast, easy, and 100% online application process. Keep in mind that checking your rate through our platform won’t impact your credit score, so you can approach us with complete peace of mind. Additionally, if your credit score isn’t perfect, we have resources and tips to help you improve it over time.

At SocietyOne, we do more than just provide loans; we want to walk alongside you, supporting and guiding you. With us, you are more than just another borrower. You’re a person with dreams and aspirations, and we’re here to help you make them a reality.

What are monthly ongoing fees?

When it comes to monthly ongoing fees, which are often referred to as loan management or handling fees, it’s vital to understand that these are charges often applied by lenders to cover the cost of maintaining your loan, and they are charged on a regular basis. What sets this fee apart is that it doesn’t directly contribute to repaying your loan principal.

However, with SocietyOne, you’ll experience a refreshingly different approach. Our service, a leading force in Australia’s finance industry, does not apply monthly ongoing fees. We understand the need for transparent and fair loan structures, and as a result, we’ve done away with monthly fees that can often seem hidden and unexpected.

Instead, we ensure our cost structure is clear. At SocietyOne, we charge a one-off establishment fee. In line with our commitment to full disclosure, this fee is factored into your total loan amount, allowing you to see upfront exactly what you’re paying for.

Similar to monthly ongoing fees, we also do not impose early repayment fees. We strongly believe in the freedom of being able to pay off personal loans early, and we don’t think you should be penalised for being financially proactive.

All of this is part of the SocietyOne promise: to offer fixed-rate personal loans with the flexibility you need to make the most of a purchase. After all, one of our goals is to help you take control of your finances without the added stress of unnecessary fees.

Here, we put value in the power of financial literacy and empowerment. Our experienced team will walk alongside you, making your financial journey not only successful but also enjoyable. We also base our process on risk-based pricing, which means that the better your credit profile, the lower your rate.

We’ve also made such an initial assessment easy for you. Checking your rate with our Credit Score Tool is safe and obligation-free, and it won’t impact your general status. It’s all part of our effort to provide a faster and fairer deal for all Australians.

All in all, monthly ongoing fees are common in the finance industry but not at SocietyOne. We stand against unnecessary charges and for financial transparency, empowering you to get what you really want, whether you’re consolidating debt, renovating a home, or purchasing a car.

Our service can help you achieve your dreams in an efficient and cost-effective way.

What are penalty fees?

Everyone has something they would like to purchase, but understanding specific loan terms and agreements can discourage aspiring borrowers. At SocietyOne, we place importance on making complex financial concepts simple, and penalty fees are no exception. These are essentially fees that only occur if repayments for personal loans aren’t made.

To give you a better idea, penalty fees, also known as late fees or overdue account fees, come into play when a consumer fails to make timely payments on a financial agreement. This could be personal loans, a credit card bill, a property rental agreement, or even an insurance plan.

Such fees are primarily designed to facilitate prompt payment by the specified deadline, and they’re outlined in the contract or agreement. Plus, lenders are typically obligated to notify borrowers of any changes to these fees in advance.

At SocietyOne, we take pride in our dedication to responsible borrowing. As such, we have established a reasonable overdue account fee. This fee is charged when a repayment deposit is seven days overdue and every fourteen days thereafter until the arrears are cleared or a cap is reached.

Alongside this, we also have a dishonour fee specified in our contract, and this demonstrates our attention to money management, transparency, and, of course, responsible borrowing. This fee is incurred each time a direct debit is dishonoured or a loan repayment commitment is not met.

While you might be intimidated by the vast realm of finance, that will no longer be the case when you choose us at SocietyOne. Know that we won’t just be here to guide you every step of the way. As Australia’s leading digital finance platform, we’re keen on providing you with more opportunities.

We do this by offering both secured and unsecured personal loans, allowing you to borrow between $5,000 and $70,000 over periods ranging from two to seven years.

One of the advantages of our service is that we offer an entirely online and simplified application process. Getting a rate from us won’t impact your credit score, so it’s both safe and obligation-free. On top of all of this, we use a fair, risk-based pricing model, which means the better your credit profile, the lower your rate.

The path to your desired purchases can be smoother than you think, and we are here to be your trustworthy companion along the way. At SocietyOne, we’re not just about personal loans; we’re about helping everyday Australians make their dreams come true.

Where do I find a personal loan lender?

In your quest for a personal loan, you may have encountered the traditional route and turned to banks and similar institutions. While this method has its merits, it could also come with queues, heaps of physical paperwork, and lengthy waiting times. To mitigate such aspects, an online personal loan lender could be your go-to option.

The good news is that SocietyOne stands out in such scenarios. We’re not just about streamlining the lending process; we also focus on enhancing the customer experience through intuitive resources.

Our hardworking team understands that taking out a loan isn’t just about receiving funds; it’s about empowering borrowers to take charge of a more fulfilling lifestyle filled with dream purchases. With our online platform, not only will the application be easy, but you’ll also get access to useful resources to help you understand and improve your situation.

As an example, our Credit Score Club shows you how to enhance your credit score, while our Credit Score Tool allows you to check your credit score without negatively impacting it. Both are unique features designed to guide you as you submit your application.

Aside from this, our lending products also cater to diverse needs, with us offering both unsecured personal loans and secured personal loans.

Unsecured loans allow you to borrow between $5,000 and $70,000 over two, three, or five years without requiring collateral. On the other hand, secured loans require an asset such as a car as collateral, providing access to larger amounts, lower rates, and longer terms due to reduced lender risk. This way, you can borrow from $5,000 to $70,000 over two, three, five, or seven years.

We at SocietyOne recognise that everyone’s preferences are unique, and generic solutions don’t always fit the bill. That’s why we offer personalised loans that cater to your specific needs, offering an alternative to the lengthy forms and convoluted application processes of the past.

Our system even employs risk-based pricing, meaning your credit score directly influences the interest rate you’re offered. This way, the terms of your loan reflect your financial standing, potentially offering you a better deal than traditional banks. Furthermore, we’re proud of the transparency we maintain, promising you no hidden fees for monthly or early repayments.

We invite you to experience a faster, fairer, and friendlier loan process where getting a rate quote is safe, obligation-free, and doesn’t impact your credit score. You can count on us at SocietyOne, your trusted partner for personal finance.

What is the best way to get a personal loan?

Beyond just convenience, competitive terms, and overall speed, the best way to get personal loans is from a lender who understands.

You no longer have to associate personal loans with daunting and challenging tasks. At SocietyOne, we’re here to guide you through the process, making it as simple and stress-free as we possibly can. We know just how unique every borrower is, and we’re committed to providing a personalised service that meets your specific needs.

The first step in securing personal loans with us is to get your rate. This procedure is quick and easy, taking as little as two minutes. We’ll provide you with an interest rate and comparison rate based on your unique credit profile, ensuring you have a clear understanding of the potential costs involved.

Once you’ve received your rate, the next step is to apply online. We’ve streamlined our application process to make it simple and straightforward. Most people complete their application within five minutes, and you can even do so anywhere and anytime – even if you’re lying in bed or preparing your morning cup of joe.

Finally, if your application has been approved, we’ll have the funds in your account within one business day. This quick turnaround time means you can start using your loan for what you need, whether it’s a new flat-screen TV or some much-needed car repairs.

What’s more, we believe that financial literacy is the key to making informed decisions and then enjoying your exciting purchases. With this, we’re committed to breaking down complex financial concepts into digestible pieces, making them accessible to all.

To understand your situation better before your application, we offer a Credit Score Tool, which allows you to check your credit score and eligibility without damaging your credit score. You also do not need to scour the web if you need tips on improving your credit score. We have a Credit Score Club resource that provides tips to improve your score, which could eventually lead to a better offer.

At SocietyOne, we’re much more than just another lender that offers personal loans. Have confidence in us, as we’re a companion that makes an effort to understand you through and through.

So, if you’re looking for a personal loan, why not take advantage of a streamlined process with us at SocietyOne? We’re here to help you make your dreams a reality. Get your rate, apply online, and get paid in no time.

What credit score is needed for a personal loan?

The credit score required for personal loans can vary significantly depending on the lender, and this is largely due to the fact that each lender has its own unique set of criteria for evaluating a borrower’s creditworthiness. These criteria are essentially the standards or benchmarks that lenders use to determine whether or not a potential borrower is likely to repay a loan on time.

Some lenders may place a greater emphasis on your income level and employment stability. They might look at how long you’ve been at your current job, the consistency of your income, and whether you have a steady employment history.

On the other hand, other lenders may place more emphasis on your credit history and current debt levels. They might look into your past borrowing and repayment habits, any late payments or defaults, and how much debt you currently have relative to your income. This is because your past financial behaviour can be a good indicator of your future behaviour.

Nonetheless, many lenders use your credit score to assess the risk associated with lending you money. A credit score is a numerical representation of your creditworthiness based on your past and current financial behaviour. Generally, a higher credit score indicates that you’re a lower risk to lenders, which can make it easier for you to secure a loan.

It can also help you secure a loan with a lower interest rate, which can save you money over the life of the loan. Conversely, a lower credit score can make it more difficult to secure a loan and may result in higher interest rates.

SocietyOne is here to be your beacon of trust and reliability in a world where financial matters can often seem intimidating. We’re not just here to provide you with financing; we’re here to empower you on your financial journey.

At SocietyOne we understand that financial matters can often seem complex and intimidating, and we’re here to make them accessible and manageable for you.

We believe in empowering our customers with the knowledge they need to make informed decisions about their financial futures. That’s why we offer our customers the ability to check their credit score and eligibility before it impacts their credit score.

We know that searching for and applying for any financial product can be challenging, with numerous providers, one-size-fits-all loans, lengthy forms, and confusing application processes. SocietyOne is here to simplify this process for you. We are the home of the faster and fairer deal, offering award-winning secured and unsecured personal loans.

How your credit score impacts your loan?

There’s no denying that credit scores play a pivotal role in applying for personal loans. While there isn’t a definitive credit score needed for a personal loan, having a good credit score can significantly improve your chances of loan approval. But what does it mean to have a good credit score?

A good credit score is more than just a number; it’s a testament to your financial responsibility and reliability. It’s a key that can unlock numerous benefits, making your financial journey smoother and more rewarding.

One of the most significant benefits of having a good credit score is that it improves your chances of loan and credit card approval. While a good credit score doesn’t guarantee approval, it certainly puts you in a favourable position when you submit your next personal loan, home loan, or credit card application.

Lenders view a good credit score as a sign of financial responsibility, which can increase their confidence in your ability to repay the loan. However, it’s important to remember that your credit score isn’t the only factor considered during the approval process. Lenders also take other factors into account, such as your income, employment status, and ability to repay a loan or credit card.

Another significant benefit of a good credit score is the potential to secure better interest rates on loans. With a good credit score and a proven track record of financial responsibility, you’re in a much better position to negotiate lower interest rates. This can save you a substantial amount of money in the long run.

It’s worth noting that risk-based interest rates, where the interest rate is determined based on the perceived risk of the borrower, are more common among personal loan products than other lending products.

Lastly, a good credit score can make it easier for you to reach your life goals. Whether you’re planning a wedding, buying a car, making home improvements, or even planning a dream holiday, a good credit score can provide you with more flexibility when it comes to making large purchases.

At SocietyOne, we stand by this proposition: the better your credit profile, the lower your rate. But don’t worry if your credit score isn’t perfect; we’re here to help you improve it. We offer tips and guidance to help you improve your credit score, which could potentially improve your loan offer. We’re not just a finance provider; we help you navigate the world of finance with confidence and ease.

How to qualify for a loan?

Qualifying for personal loans is a process that involves meeting certain requirements set by lenders. Researching lenders is an important step, as different lenders have different eligibility requirements, so it’s crucial to find one that aligns with your financial situation. Once you’ve found a suitable lender, you can begin the loan application process.

And while each lender’s requirements can vary, there are some common factors that most lenders consider when reviewing loan applications.

Typically, the first step in this process is checking your credit score. A good credit score can significantly improve your chances of qualifying for a loan. It’s advisable to check your credit score and report before applying for a loan to ensure they are accurate and up-to-date.

Income is another crucial factor. Lenders need to know that you have a steady source of income and can afford to repay the loan. You’ll typically need to provide proof of income, such as pay stubs or tax returns, during the application process.

Personal information is also usually required when applying for a loan. This includes your name and address, as well as information about the loan amount you’re seeking and the purpose of the loan.

After submitting your application, you’ll usually need to wait for the lender to review it and make a decision. If you’re approved, the lender will provide you with the loan terms, including the interest rate, repayment period, and monthly payment amount, if this is part of their process for personal loans.

At SocietyOne, we firmly believe in responsible lending. This means we’re committed to providing loans that are suitable for our borrowers and won’t lead to financial distress. Our specific criteria for borrowers are designed with this principle in mind. Now, if you’re considering SocietyOne for your loan needs, we have specific requirements for our borrowers:

- You need to be at least eighteen years old.

- You must be an Australian citizen or permanent resident.

- You should have an annual income of at least $30,000 and a good credit profile.

Our lending criteria are not just boxes to be checked. They are part of our holistic approach to responsible lending. We set these criteria to help ensure that we’re providing personal loans that our borrowers can manage, thereby helping them avoid financial binds.

Does being declined hurt credit?

When it comes to getting personal loans, there’s a common concern: does being declined hurt your credit? Getting declined for a credit card or loan does not always directly hurt your credit score. However, there are factors to consider that could indirectly impact your credit health.

Whenever you apply for credit, the lender may review your credit report, resulting in a hard enquiry. These enquiries can cause a slight drop in your credit scores and remain on your credit report for two years. This could happen whether you’re approved for or denied the loan.

While getting declined may not directly hurt your credit score, it’s still a good idea to manage your credit applications wisely. Too many hard enquiries within a short period of time can have a cumulative negative effect on your credit scores.

If you’re declined for credit, assess the reasons why you might have been denied and try to address them before applying for another loan. There are steps you can take to improve your chances of being approved in the future.

Lenders prefer a history of responsible repayment. If you have missed payments, regularly max out your credit cards, or have other negative information on your credit report, it could impact your chances of approval. Work on building a good borrower profile before applying for credit.

It’s also recommended to review your credit reports regularly for errors and dispute any inaccuracies you find.

At SocietyOne, we understand the importance of credit health. That’s why we offer a Credit Score Tool that allows you to check your credit score and eligibility before impacting your credit score. We’ve helped thousands of everyday Aussies access funds for a wide range of needs, and more importantly, our customers love and trust our services.

And remember, getting a rate with us won’t impact your credit score, so it’s safe and obligation-free. Let SocietyOne help you make better decisions for your financial goals.

Can I get a personal loan without affecting my credit score?

Navigating the world of personal loans can often feel like a tightrope walk, especially when you’re concerned about the potential impact on your credit score. Most lenders will conduct a hard credit check when you apply for a loan, which could appear on your credit report and potentially impact your credit score.

In some cases, there are lenders that offer loans without conducting a credit check; instead, they may look at alternative data such as income, banking data, and rental history to determine your eligibility to borrow. This is often referred to as a ‘no credit check loan’.

However, these types of loans may come with several disadvantages, including higher interest rates, added fees, lower borrowing limits, and stricter repayment terms.

If you’re concerned about your credit score, it may be beneficial to work on improving it before applying for a personal loan. This can help you qualify for better loan terms and interest rates in the future.

At SocietyOne, we offer secured and unsecured personal loans that you can use for any worthwhile purpose. The best part? You can receive a rate without affecting your credit score. We use what is called a ‘soft check’ to get your credit score from the credit bureau, which allows us to calculate a personalised rate for you.

Once you have submitted your loan application, we will conduct a credit check as part of our assessment process. This check is known as a ‘hard check’ and will be reflected in your credit score.

At SocietyOne, we believe that applying for a personal loan should be as straightforward and stress-free as possible. That’s why we’ve designed our application process to be easy and hassle-free, allowing you to focus on what matters most – achieving your financial goals.

From application to tracking your repayments, our digital finance platform makes sure everything is accessible and convenient for you from start to finish. Because our process takes place entirely online, you can apply for a loan whenever you need to and from wherever you are in Australia.

What credit score is too low for a loan?

The question of what credit score is too low for personal loans is a common one, and the answer is not as straightforward as one might think. The minimum credit score required for a loan can vary depending on the lender and the type of loan. Each lender may have its own specific criteria and requirements.

For instance, some lenders might be willing to approve a personal loan for a borrower with a fair credit score, while others might require a score that’s above average. It’s also worth noting that different types of loans have different credit score requirements. A loan with a larger amount, for example, might have stricter credit score requirements compared to a small loan.

However, it’s crucial to remember that your credit score is not the only factor that lenders consider when deciding whether to approve your loan application. Other factors, such as your income, debt-to-income ratio, and employment history, also play a significant role.

Your income and employment history can give lenders an idea of your ability to repay the loan, while your debt-to-income ratio, which is the percentage of your monthly income that goes towards paying debts, can indicate whether you’re overextended.

The good thing is that the advent of online lending platforms like SocietyOne has dramatically changed the lending landscape. Gone are the days when getting personal loans meant dealing with tedious paperwork and long waiting periods at traditional banks. SocietyOne, Australia’s leading digital finance platform, offers a more streamlined and efficient approach to lending.

With SocietyOne, you can apply for a loan online, get a personalised rate within just a few minutes, and receive funds in as little as one business day if approved. This swift turnaround time is a game-changer, particularly for those who need urgent access to funds.

Whether it’s for an unexpected expense, a home renovation project, or a dream holiday, SocietyOne makes it easier for borrowers to access the funds they need when they need them. Even better: at SocietyOne, the better your credit profile is, the lower the rate we can offer you.

SocietyOne’s innovative approach to lending is a testament to the evolution of the financial industry. By leveraging digital technology, SocietyOne is able to meet the needs of today’s consumers, who value convenience, speed, and fairness.

This shift towards digital lending is not just about making the process easier for borrowers; it’s also about empowering them and giving them more control over their financial futures.

How to refinance?

Refinancing a loan is a process that involves several steps, each designed to ensure you get the best possible terms for your financial situation.

Typically, the first step in refinancing personal loans is to check your credit score and credit report. This is a crucial step because it helps you gauge whether you qualify for a lower interest rate than what you’re currently paying. Your credit score represents your creditworthiness, and lenders use it to determine the risk they take on when lending to you.

Next, you should contact your existing lender. This is an important step because your current lender may be able to offer you a better rate or more favourable terms to keep your business. Let them know that you’re considering refinancing and ask about the revised rate and terms they’re willing to offer.

The third step is to shop around. This involves comparing rates and terms from different lenders to find the best deal. You can pre-qualify with multiple lenders to see the rate and terms you can get on a new loan. Pre-qualifying typically doesn’t affect your credit score, and it allows you to compare new loan offers with the terms of your existing loan. However, every lender is different, so make sure to double check with them to make sure that their pre-qualification checks are indeed safe for your credit score.

Once you’ve found a lender with favourable terms, the next step is to apply for the loan. This involves completing a formal application with the new lender and providing any documents they may need to verify your details and income.

If you’re considering refinancing your loan, SocietyOne could be an excellent choice to consider. We offer both secured and unsecured personal loans, making it easier for you to find an option that fits your unique financial situation.

One of the key advantages of choosing SocietyOne for your refinancing needs is our competitive rates. We pride ourselves on offering comparison rates for personal loans that can be lower than traditional bank loans. This is part of our commitment to providing a faster and fairer deal for our customers. We believe that you deserve better, and we’re here to deliver.

Moreover, we use risk-based pricing. This means that the better your credit score, the lower your interest rate. We reward responsible financial behaviour, and we believe that those with good credit profiles should have access to attractive loan terms. This approach sets us apart from many traditional lenders and is part of our commitment to fairness and transparency.

When to refinance?

Deciding when to refinance your personal loans is a decision that hinges on your unique circumstances and the type of loan you have. It’s a process that requires careful consideration.

For mortgages, refinancing can be a smart move when you’re confident of receiving a financial benefit. This could be in the form of a lower monthly mortgage payment, improved overall loan terms, or tapping into your home equity. It’s also a good idea to refinance when you qualify for more competitive loan terms and plan to stay in your home for a while to reap the cost savings.

When it comes to personal loans, refinancing can be beneficial when you can secure a better interest rate that will save you money. It’s also a viable option when you need to borrow more money for a new expense or financial need. However, it’s crucial to remember that refinancing should be considered when the interest rate of your initial loan is higher than your current options.

For car loans, refinancing can be useful when you can secure a better rate or more manageable repayments. In essence, refinancing makes the most sense when the interest rate or monthly payments are lower than your current loan.

However, it’s important to weigh up the costs associated with refinancing, such as closing costs and fees, and whether you plan to stay in your home or keep your car long enough to recoup those costs.

At SocietyOne, you can trust that there are no hidden fees associated with your personal loans. What’s more, we’re always here to help, no matter when you choose to refinance your loan.

Gone are the days when you were stuck with the typically tedious processes of traditional banks when refinancing a loan. The conventional banking system, with its lengthy forms and confusing application processes, can often feel overwhelming and impersonal. At SocietyOne, we’ve transformed this experience.

We understand that time is of the essence, especially when it comes to financial decisions. That’s why we’ve streamlined our process to provide you with a personalised rate in as little as two minutes. We’ve embraced technology to create a faster, more efficient process. Our 100% online application process means you can apply from the comfort of your own home at a time that suits you.

There’s no need to go to a bank, wait in line, or navigate through complex paperwork. Instead, you can complete your application quickly and easily online, with our team ready to assist if you need any help.

How do I start refinancing?

Getting into refinancing can seem like a hassle, but it doesn’t have to be. Whether it’s personal loans or other types of loans, the process generally involves a series of steps. First, you need to identify your goals for refinancing. This could be to lower your monthly payments, improve your loan terms, or tap into your home equity.

Once you’ve set your goals, it’s essential to ensure your finances are in good shape before starting the refinancing process.

Next, it’s time to shop around. Look for the best rates and apply to refinance with multiple lenders. This allows you to compare their interest rates and fees. Once you’ve chosen a lender, you’ll need to complete a formal application and provide any necessary documents to verify your details and income. Finally, you’ll close on your new loan.

At SocietyOne, our personal loans are designed to offer a streamlined way to access financing. Instead of going through the often complex and time-consuming process typically associated with traditional loans, you can apply for a personal loan with us. This can be a more straightforward and efficient way to access the funds you need, whether it’s for debt consolidation, home renovations, or a car purchase.

To get started on your refinancing journey, all you need to do is begin our online process for applying for personal loans. We operate entirely online, making us accessible to anyone, anywhere in Australia, at any time. Our commitment to providing a superior customer experience has earned us recognition in the industry, but more importantly, the trust and loyalty of our customers.

What’s more, you decide how much you want to borrow and pay it back over the time that you choose.

As Australia’s leading digital finance platform, SocietyOne offers both unsecured and secured personal loans. With our unsecured loans, you can pay them off over two, three, or five years. Our secured loans, on the other hand, allow you to repay over two, three, five, or seven years with the loan secured against an asset.

We believe in a fairer, simpler, and faster approach to personal loans. Our risk-based pricing model means that the better your credit profile, the lower your rate. And with no hidden fees, you can manage your loan in a way that suits you best.

How to successfully refinance?

Refinancing personal loans can be a strategic move to better manage your finances. But without the right know-how on how to do it successfully, it can do more harm than good to your finances.

To successfully refinance, it’s first essential to identify your reason for refinancing. This could be to secure a better interest rate, lower monthly payments, consolidate debt, or shorten the loan term. Understanding your goals will help you make informed decisions throughout the process.

Your credit score plays a significant role in refinancing. Most lenders consider your credit score when evaluating your application. If your credit score has improved since you took out the original loan, you may be eligible for better rates. At SocietyOne, we even offer a Credit Score Tool that allows you to check your credit score for free.

Reviewing your current loan is another crucial step. Understand the terms and conditions of your existing loan, including the interest rate, repayment period, and any fees or penalties for early repayment. This will help you assess whether refinancing is the right move for you.

Choosing the right lender for refinancing is a critical decision that can significantly impact whether you succeed in refinancing or not. It’s not a decision to be taken lightly, and it’s important to shop around and compare rates and terms from different lenders. This process involves evaluating the interest rates, loan terms, fees, and customer service of various lenders to find the best fit for your needs.

At SocietyOne, we offer competitive rates for both unsecured and secured personal loans, catering to a wide range of financial needs.

What sets us apart is our commitment to a fair deal. We believe that your credit profile should be a tool that empowers you. That’s why we use risk-based pricing, which means the better your credit profile, the lower your interest rate. This approach rewards responsible financial behaviour and can result in a rate that’s likely to be lower than what traditional banks offer.

At SocietyOne, we’re not just a lender; we’re a partner in your financial journey. We’re committed to providing a transparent, straightforward lending experience that puts you in control. Our goal is to empower you to make the best financial decisions for your unique circumstances, and we’re here to support you every step of the way.

Does refinancing start you over?

Refinancing, in essence, is the process of replacing existing personal loans with new ones, often with different terms and conditions. The new loan pays off the old one, and you’re left with the new loan to repay. This process can extend the term of your loan and the unpaid balance to match the new loan’s terms.

At SocietyOne, we understand that some borrowers view the concept of refinancing as starting over. However, it’s more accurate to view it as an extension of your loan’s lifespan. It’s not necessarily bad; in fact, there are valid reasons why borrowers may need or want to refinance their personal loans.

As with any financial decision, it’s crucial to approach refinancing responsibly. Understanding the responsibilities involved in your refinance loan is crucial before fully committing to one. Since refinancing involves new loan terms or agreements with your credit provider, always clarify points that differ from your earlier loan.

This is particularly important when it comes to repayment schedules or added charges. Most refinance loans require establishment fees or include penalty fees for past missed payments.

Another critical factor to consider before deciding to refinance your loan is your credit score. Your credit score is a numerical representation of your creditworthiness, and it can significantly impact the terms of your new loan, including the interest rate. That’s why we encourage you to check your credit score before making any decisions about refinancing.

Now, you might be wondering, ‘Won’t checking my credit score affect it negatively?’

At SocietyOne, we allow you to check your credit score and eligibility without impacting your credit score. This means you can get a clear picture of your financial standing and make informed decisions about refinancing without worrying about damaging your credit score.

However, once you have submitted your loan application, we will conduct a ‘hard check, which will be reflected in your credit score, as part of our credit assessment process.

We’re also proud to offer a fast, easy, and 100% online application process. You can apply at a time that suits you, whether that’s in the evening or over the weekend. Our online application process can be completed in just a few minutes. You’ll be asked to provide some basic information about yourself and your financial situation.

What to consider when refinancing?

When considering refinancing loans, it’s important to approach the process with a clear understanding of your objectives and the factors that can influence the outcome.

Firstly, it’s crucial to identify your reason for refinancing. This could be to reduce your monthly payment, shorten your loan term, or tap into your home equity for repairs or debt repayment. Your motivation for refinancing will guide your decision-making process and help you determine the most suitable loan product for your needs.

Your credit score and report are significant factors in the refinancing process. These elements influence whether you qualify for refinancing and the interest rate you’ll receive. SocietyOne offers a Credit Score Tool that allows you to check your credit score and eligibility without impacting your credit score, making this step easy and risk-free.

Finally, it’s essential to keep track of your personal loans and make payments on time to avoid any potential issues.

SocietyOne’s transparent and fair approach to lending ensures that you have all the information you need to make an informed decision. Refinancing can be complex, but with the right knowledge and a trusted lender like SocietyOne, you can navigate the process with confidence. We’re here to help you make the important decision about whether refinancing is right for you.

Additionally, SocietyOne’s user-friendly platform makes managing your loan straightforward and stress-free. Whether you are applying for a loan, checking your loan information, or making repayments, the platform is designed to be intuitive and easy to navigate, ensuring that you can effortlessly handle your financial needs.

Our approachable and knowledgeable team is ready to answer your questions and guide you through the process.

We understand that you may have questions or concerns at various stages of the loan process. Thus, we have trained our team members to be friendly, understanding, and well-informed. Whether you have questions about refinancing your existing loan or getting new personal loans from us, our team is prepared to provide timely and accurate assistance.

Who provides refinance personal loans?

When it comes to refinancing personal loans, you can find options with various online lenders. If you’re considering refinancing your loan, you’ll be delighted to know that we, at SocietyOne, offer personal loans designed for any worthwhile personal use.

We understand that navigating the world of finance can be overwhelming, and that’s why we’ve made it our mission to offer secured and unsecured personal loan options that cater to different needs. Whether you’re looking to consolidate debt, renovate your home, or purchase a car, our user-friendly platform and knowledgeable team are here to guide you through the process.

What makes us stand out is our commitment to making the loan application process easier and fairer for you, our valued customers. We know that personal loans are a tried and tested form of credit, but we also understand that finding the right provider and navigating the application process can be daunting. That’s where we shine.

With a focus on faster and fairer deals, our award-winning secured and unsecured personal loans have helped thousands of everyday Aussies like you access funds for a wide range of needs. But, more importantly, our customers trust our services.

One of the best parts of the SocietyOne experience is our Credit Score Tool, which allows you to check your credit score and eligibility for free without impacting your credit score. We understand that not everyone has a perfect credit score, and that’s okay. With our Credit Score Club, we’ll provide you with some common tips to improve your score in no time, which could eventually lead to a better loan offer.

Our single-minded proposition is simple: the better your credit profile, the lower your interest rate. We use risk-based pricing, which means the better your credit profile, the lower your rate. This is likely to be lower than what you could get from a traditional bank. Additionally, you can enjoy a fast, easy, and 100% online application process.

When seeking to refinance your personal loan, consider us, SocietyOne, as your reliable companion on your financial journey. We’re here to make the process straightforward and stress-free, with our approachable team ready to answer your questions and guide you through every step.

With our dedication to providing a better financial experience, you can be confident in taking control of your financial future with us by your side.

Does refinancing hurt your credit?

Refinancing a loan can have an impact on your credit, but the extent of that impact largely depends on your individual financial situation and how you manage the refinancing process. As an approachable and trustworthy financial platform, SocietyOne understands that this is a common concern for our Australian customers, and we’re here to break down the implications for you.

When you refinance personal loans, the lender will typically conduct a hard credit check. This is a standard procedure to assess your creditworthiness and determine the terms of the new loan. It can result in a slight, temporary decrease in your credit score. However, the impact is typically minimal, and credit bureaus recognise that borrowers may shop around for better loan terms.

What you can do to prevent your credit score from continuing to be negatively impacted is to ensure that you:

- Make timely payments. Making on-time payments is one of the most crucial factors in maintaining a healthy credit score. Whether it’s your current loan or the refinanced one, ensure that you make all your payments promptly. Consistent, timely payments demonstrate responsible financial behaviour and positively influence your creditworthiness.

- Research and compare. Before proceeding with a refinance, take the time to compare different lenders and loan options. Thanks to SocietyOne’s user-friendly platform, you can easily explore various loan offers and assess how they align with your needs.

- Minimise credit applications. While it’s essential to shop around for the best refinancing deal, avoid submitting multiple loan applications simultaneously. Each formal loan application triggers a hard credit check, which can have a temporary negative impact on your credit score.

- Understand the terms. Before committing to a refinance, thoroughly review and understand the terms and conditions of the new loan. Ensure that you are comfortable with the interest rate, repayment schedule, and any associated fees. Being well-informed will help you avoid any potential issues in the future that could affect your credit.

Make the smarter choice for your refinancing needs and learn more about our personal loans. With us, the better your credit profile, the lower your rate.

Unsecured personal loans vs. secured personal loans

Navigating the world of personal loans can be a complex task, but SocietyOne is here to simplify it for you. We offer two types of personal loans: unsecured and secured.

Unsecured loans are a fantastic option for those who want a straightforward, fuss-free borrowing experience. They don’t require you to provide any collateral, which means you can apply without needing to detail any assets as security. This makes the application process faster and more convenient, allowing you to access funds swiftly when you need them.

Secured loans, on the other hand, are a different kind of offering. They require an asset, such as a car, motorbike, or boat, to be offered as security against the loan. As part of the verification process, you’ll be required to furnish details about the asset, evidence of ownership or the purchase invoice, and documentation of insurance coverage.

This might seem like an extra step, but it comes with its own set of advantages.

One of the key benefits of a secured loan is the potential for a lower interest rate. Because the lender’s risk is reduced by the presence of collateral, they can often be offered more competitive rates. This can make a significant difference over the life of the loan, potentially saving you a considerable amount of money.

Another advantage of secured loans is the possibility of accessing a larger loan amount and longer loan terms. This can be particularly beneficial if you’re planning a significant purchase or investment, such as a home renovation or a new vehicle. Longer loan terms can also make your regular repayments more manageable, providing you with greater flexibility in your budget.

It’s also worth noting that secured loans can be a valuable tool for building credit. By successfully repaying a secured loan, you can demonstrate to lenders that you’re a reliable borrower, which can help improve your credit profile over time. This can help you secure even more favourable funding options in the future.

In essence, both unsecured and secured loans have their unique benefits, and the choice between the two will depend on your individual circumstances and financial goals.

At SocietyOne, we’re committed to helping you navigate these options by providing clear, accessible information to empower you to make appropriate decisions for your financial future. We’re more than just a lender. We’re your partner in navigating the world of funding, whether you’re looking for a secured or unsecured personal loan.

What is a personal unsecured loan?

An unsecured loan doesn’t require any assets as collateral, making it a good financial option if you don’t have or don’t want to use tangible assets but need money. It levels the playing field, ensuring everyone has access to financial tools to fulfil their dreams and aspirations. At SocietyOne, you could borrow an unsecured loan with terms of two, three, or five years.

Say you wish to consolidate your existing debts into one easy-to-manage payment to free up your monthly budget and eliminate your financial stress. An unsecured loan can help streamline your obligations and improve your financial situation.

Or perhaps you’re preparing for a life-changing event like a wedding and want to ensure it’s a day to remember. An unsecured loan could assist you in financing that dream wedding you’ve always envisioned without needing to attach an asset to your loan.

Furthermore, if you’re planning to make environmentally friendly improvements to your home, like installing solar panels, or maybe you’re just looking for a way to finance your next holiday adventure, an unsecured loan can help make these dreams a reality.

And let’s not forget those eyeing educational advancement – an unsecured loan can assist you in financing a postgraduate degree or professional certification that could open doors to career progression.

On the other end of the spectrum, SocietyOne also offers secured personal loans. These loans involve offering an asset, such as a car, caravan, motorbike, or boat, as security against the loan. It’s a preferred choice when you wish to leverage an owned asset to unlock greater benefits. This loan can be payable for up to seven years.

Secured loans often come with appealing advantages. As a result of the collateral, these loans can often offer a lower interest rate, larger loan amounts, and longer loan terms. This means your regular repayments can be more manageable, and you can spread the cost of a large purchase over a longer period of time.

Whichever loan you choose, SocietyOne is proud to provide a knowledgeable, confident, and trustworthy service to Australians. We’re here to guide and support you, understand your needs, and help you take control of your financial future.

Whether it’s making your dream wedding come true, bringing green energy to your home, or funding the trip of a lifetime, SocietyOne’s secured and unsecured personal loans are designed to empower you.

Who provides unsecured personal loans?

Unsecured personal loans are provided by a wide variety of lenders in Australia, such as banks and credit unions.

But when it comes to seeking a finance provider that combines trust, reliability, and a customer focus approach, you can turn to us at SocietyOne, Australia’s leading digital finance platform. SocietyOne has been recognised for award-winning personal loans, both secured and unsecured, catering to a diverse set of financial needs.

By breaking down complex financial jargon into manageable terms, SocietyOne makes the process straightforward for you. The option to choose between secured and unsecured loan options, along with flexible repayment schedules – monthly or fortnightly – and loan terms of up to seven years, adds a layer of adaptability to suit your lifestyle and financial situation.

Our online application process at SocietyOne makes it even easier. You can apply in as little as five minutes, and once approved, you could have the funds in your account within one business day. There’s no need to navigate through lengthy forms and confusing processes – it’s fast, easy, and completely online.

Our approach to finance is fair and transparent. We’re always upfront with our pricing, and there are no hidden fees or ongoing fees. Even better, if you find you’re able to pay off your personal loan early, there are no early repayment fees for doing so. SocietyOne is there to walk alongside you in your financial journey, supporting you every step of the way.

In line with our commitment to financial literacy, SocietyOne offers additional resources, such as the Credit Score Tool. This allows you to check your credit score and eligibility for free. Even if your credit score isn’t perfect, you’re not left in the dark. Plus, our Credit Score Club can provide tips to help improve your score over time, potentially enhancing your future loan offers.

Whether you’re looking to consolidate debt, embark on home renovations, or purchase a car, SocietyOne is here to help you make it happen. We understand that personal loans are not an end in themselves but a means to fulfilling your aspirations. That’s why we are dedicated to providing a financial solution that is as unique as you are.

How much can you borrow?

The amount you can borrow will depend on the lender and your financial situation. At SocietyOne, we’ve got you covered when it comes to borrowing money. You can choose the amount you want to borrow right from our app.

But remember, the amount of loan you can access will still depend on two things. The first one is your serviceability. Now, that’s a fancy term for a straightforward concept — it’s simply a calculation of how much you can comfortably afford to repay.

We analyse this because we don’t want you to lose sleep over repayments. So think about what works best for you. How much can you afford to pay back without any worry? We want the amount you borrow to suit your situation, ensuring each payment is comfortably within your means.

The second factor we consider in determining the amount you can borrow is the type of loan you’re after. You may find that our unsecured personal loan can already help you access the funding you need.

But let’s say you’re contemplating a larger loan amount. You may want to consider secured loans – an additional loan you could apply for where your loan is backed by an asset such as a vehicle. This often means you can get a lower interest rate, borrow a larger amount, and have a longer time to pay it back. It all adds up to make your regular payments easier to manage.

And just in case you have a specific amount in mind but are not sure what your repayments might look like, you can check out the Loan Calculator on this website. It’s a handy tool that can give you an idea of what your repayments might be based on the loan amount you choose, loan type, repayment term, and credit history.

One thing that makes us stand out is our risk-based pricing. Basically, if you have a good credit profile, your loan could come with a better deal. And guess what? We don’t have monthly fees, hidden charges, or early repayment fees, so you won’t be surprised by additional charges down the line.

We know that finding and applying for the right loan can be a bit of a hassle. That’s why we’re here to make it easy for you. At the end of the day, we want you to be on top of your finances by offering a loan option and a loan amount that you can repay.

Are unsecured loans hard to get?

The short answer is: not necessarily. It’s all about finding the right lender who values you and understands your unique situation. That’s where we at SocietyOne can help.

Navigating through loan options might feel overwhelming, but rest assured that our online application process is as easy as it gets. It’s designed to be quick and efficient, letting you get a quote in just two minutes. And the good news doesn’t stop there. You might be able to wrap up the entire application over your morning coffee, typically within five minutes.

So, what do you need to get started? For unsecured loans, we’ll need your personal details like name, address, date of birth, proof of your address, and income. We’ll also need information about your regular expenses and any other debts.

If you’re eyeing secured personal loans, you actually don’t need to worry much about too many requirements. We’ll only ask you for additional documentation for the asset you’re pledging as security, but the whole process is very fast and simple.

Once we have your details, our team will work quickly. Our aim is to give you the quickest turnaround time possible. If your application is approved, we’ll have the loan funds in your account in as little as one business day. Sounds simple enough, right?

But what sets SocietyOne apart, you ask? Well, we have a unique proposition. The better your credit rating, the better the loan deal we can offer you. We call this risk-based pricing, and it’s all about rewarding good behaviour, and we believe you deserve it. Plus, there are no monthly fees, hidden charges, or early repayment fees, so you can easily manage your finances.

At SocietyOne, we offer an experience far from what you’d usually expect from some traditional banks, making accessing personal loans easy for everyone. So, whether it’s unsecured loans, secured loans, or something else that you need assistance with, we’re here to help you every step of the way.

Remember, getting an unsecured loan doesn’t have to be hard. With SocietyOne, you have a friendly, approachable, and knowledgeable partner ready to make your loan journey as smooth and stress-free as possible.

What credit score is needed for an unsecured personal loan?

This will depend on the specific lender offering unsecured personal loans. At SocietyOne, we consider each loan application on its individual merits.

The credit score needed for an unsecured personal loan isn’t a one-size-fits-all number, as it could depend on several factors, such as the loan amount and term you’re applying for. Your personal situation, such as employment status and income, could also matter.

This individualised approach reflects our values as we strive to provide loans that are tailored to each person’s unique circumstances. To give you a better idea, the higher your credit score, the more likely you are to be approved for an unsecured loan.

But are you concerned about the impact of applying for a loan on your credit score? Rest assured, receiving a quote from us will not affect your score. We do this by using a ‘soft check’ to obtain your credit score from the credit bureau.

It’s important to note that once you’ve submitted your loan application, we will conduct a ‘hard check’ credit check as part of our credit assessment process. This check could have an influence on your credit score.

And to help you have clarity on your credit standing, accessing your credit score with SocietyOne is not only free but also a straightforward process. We are committed to making financial literacy accessible, so we have made it easy for you to check your credit score without fear of impacting it negatively.

Simply have your driver’s licence handy for identity verification, and you can access your credit score information in just a minute on our mobile app. Once you’re registered on our Credit Score Tool, you can even track your progress in improving it over time.

This can also help you spot irregularities or incorrect information on your credit report, so you can be confident about your credit ranking. We can even help you take the next step in reporting any issues in your file!

And for those looking to improve their credit score, we also provide a comprehensive Credit Score Guide you can check out. This is filled with useful tips and tricks that can help you boost your score, potentially making it easier for you to secure favourable loans in the future.

Remember, our aim at SocietyOne is not just to provide loans but to empower you with the knowledge and tools necessary to take control of your financial future.

How to compare personal loans?

In your quest to find the best personal loans, a few key features stand out as significant markers. Knowing how to perform comparisons can save you both time and money.

Start by investigating the interest rates on multiple offers. Remember, this is the cost you’ll pay over the loan term on the borrowed sum. Ensure you’re comparing apples with apples, looking at the same loan amounts and terms, for accurate comparisons.

Application fees come next on your list. It’s the charge that greets you when you step into the loan application process. But don’t stop there! Keep an eye out for other fees, such as monthly service charges, default fees, or missed payment penalties. Scrutinising the fine print of the loan terms and conditions can reveal these hidden costs.

Increasing your repayments will help you pay off your debt faster and save on interest, so check if the loan you’re eyeing allows for this without incurring penalties. Also, keep in mind the intended purpose of the loan – are you borrowing for a new car, home renovations, or something else? Ensure the loan you select aligns with your objectives.

Next, you’ll want to check out the comparison rate. It’s a comprehensive figure that combines the interest rate with most fees. A comparison rate gives you a holistic understanding of the loan’s total cost.

Lastly, consider the loan term. Shorter terms may feature lower interest rates but demand higher repayments. Longer terms, on the other hand, may have lower repayments but accrue more interest over time.

SocietyOne is with you every step of the way. As Australia’s leading digital finance platform, we make the financial maze manageable with our range of personal loans, both unsecured and secured. With our user-friendly online application process, applying for a loan is quick and hassle-free.

What sets us apart? We believe in providing fair deals for borrowers with our risk-based pricing model, meaning that a better credit profile could result in a lower rate. And the cherry on top? Getting a quote from us won’t dent your credit score. It’s safe and obligation-free.

Moreover, we have handy tools like our Credit Score Tool to check your credit rating and eligibility without affecting your credit score. Plus, our Credit Score Club is packed with practical tips to help improve your credit score over time. At SocietyOne, we stand as your trustworthy companion, guiding you to make informed financial decisions for a brighter financial future.

What is a comparison rate on a personal loan?

The comparison rate on personal loans is a powerful tool designed to help you understand the true costs involved. This rate incorporates not only the interest rate but also the known fees and charges payable over the loan term, such as establishment fees. This way, you get a more transparent picture of what a personal loan will cost, with all significant elements condensed into a single percentage figure.

It helps you see beyond the advertised interest rate, factoring in other charges you’ll need to pay during the loan’s lifetime. It offers clarity, enabling you to compare different personal loans and discern any hidden fees or charges, so you won’t experience unwanted surprises later on.

Now, how is a comparison rate calculated, you might ask? The calculation considers the loan amount, term, frequency of repayment, interest rate, and known fees and charges. Remember, when comparing different loans using their comparison rates, make sure you’re comparing loans with similar amounts and terms. This ensures a fair, like-to-like comparison.

There is, however, an important point to keep in mind: a comparison rate does not include fees and charges that may only occur in the future, such as if the loan is varied or if a payment is late. Therefore, it’s crucial to read the terms and conditions of each personal loan offer carefully to fully understand all potential costs.

We at SocietyOne understand how crucial transparency and understanding are when it comes to making financial decisions. That’s why we ensure that our comparison rates are as transparent and comprehensive as possible, reflecting the trust and reliability that we stand for. To prove this, you can hover over this website to see how our comparison rate compares to other lenders.

Moreover, we pride ourselves on making complex financial concepts like comparison rates easy to understand and supporting our customers in their financial journey. We stand alongside our borrowers as a beacon of financial literacy, turning what can be an intimidating world of finance into a walk in the park. SocietyOne’s personal loans are fair, fast, and fully online.

Remember, personal loans can indeed be a valuable tool to help make your goals a reality, be it debt consolidation, home renovation, or car purchase. And understanding the comparison rate is an essential first step in making the most of your personal loan. So, don’t hesitate to take a step into the world of better, personalised deals with SocietyOne.

What is the most effective rate to consider when comparing loans?

As a comprehensive understanding of a loan’s actual cost is offered by the comparison rate, it stands out as the most effective method to evaluate loans. The importance of it should not be overlooked, especially considering the dangers of ignoring it when comparing loan options.

For instance, let’s look at two loans with the same interest rate. Loan A has low fees, while Loan B, although offering enticing benefits, has high associated costs. At first glance, you might be drawn to Loan B because of its advantages.

But when you consider the comparison rates, you could find that Loan B is substantially more expensive than Loan A in the long run due to its additional charges. This makes Loan A more affordable, which could be a better choice based on your financial capacity and goals.

Now consider a different scenario. Loan X has a slightly higher interest rate than Loan Y but significantly lower fees. Many borrowers might immediately discard Loan X due to its higher interest rate, yet when the comparison rate is applied, Loan X might turn out to be the more cost-effective option over time.

In another situation, two personal loans might seem to have similar comparison rates, making it challenging to choose between them. However, consider the loan terms. A loan with a longer term might have a low comparison rate but could incur more interest payments over its lifespan.

Shorter-term loans, while having higher monthly payments, could save you money overall due to lower total interest payments.

However, it’s perfectly natural if you’re still concerned about the interest rate, as it remains a significant aspect of your loan. At SocietyOne, we understand this, which is why our personal loans come with a fixed interest rate.

This means the interest rate remains constant throughout the duration of your loan, resulting in regular repayments that are predictable and consistent. This can make budgeting easier for you, and without any ongoing fees, hidden charges, or early repayment fees, our personal loans provide you with the liberty to settle your debt easier and sooner if you wish.

The comparison rate shines a light on the true cost of a loan, equipping borrowers with a valuable tool to make well-informed financial decisions. It’s an essential part of SocietyOne’s commitment to offering clear, straightforward information to our customers, empowering them to control their financial futures confidently and intelligently.

Of course, when you need help understanding these specifics, feel free to reach out. We can help you determine a suitable loan based on your financial situation.

What three things should you pay attention to when comparing loans?

When diving into the world of loans, it’s essential to pay attention to three crucial elements – rates, fees, and loan terms. These are the factors that can significantly influence the total cost of a loan and impact your financial decisions.

Starting with rates, they are made up of two parts: the interest rate and the comparison rate. The interest rate can be fixed or variable. SocietyOne offers a fixed interest rate, which ensures that your repayments remain the same throughout the term of the loan, providing a sense of security and simplicity in budget planning.

On the contrary, variable interest rates fluctuate based on market conditions, leading to varying repayments. An increase in interest rates would mean higher repayments, while a decrease would lower your repayment amounts.

SocietyOne stands out in offering personalised rates, ensuring fairness and consideration of individual circumstances. Your credit score is a key determinant here, meaning the higher your score, the lower your rate could be.

Then there’s the comparison rate, which incorporates the interest rate as well as most upfront and ongoing fees and gives a more comprehensive picture of the loan’s total cost per year. It is possible for two loans to have identical interest rates but differing comparison rates due to fees.

It helps to get a clearer picture, stressing the importance of considering both the interest and comparison rates.

Next, let’s delve into the fees. These charges can significantly add to your loan’s total cost. Some loans might impose monthly fees or early repayment fees, penalising you for repaying your loan sooner.

SocietyOne, however, believes in transparency and simplicity. We provide a clear fee structure without hidden charges, allowing you to plan your repayments without worrying about additional costs. Additionally, we don’t penalise early repayments, offering you the flexibility to pay off your loan sooner if you’re able.

Finally, loan terms are a pivotal point of comparison. The loan term is the period during which you’ll be making repayments. While shorter loan terms typically lead to higher monthly payments, they also result in less interest paid over the loan’s life.

In contrast, loans with longer terms generally have lower regular repayments, but you’ll pay more interest over time. SocietyOne offers flexible loan terms for both unsecured and secured personal loans, giving you the freedom to choose a loan term that aligns with your financial position and repayment capability.

As a reliable Australian financial platform, SocietyOne embodies an approachable, trustworthy, and understanding approach, providing clear and concise information to make these complex financial concepts easily understandable.

Our commitment to fixed rates, no ongoing fees, hidden charges, or early repayment fees, and flexible loan terms is part of our mission to accompany you on your financial journey, ensuring your path is paved with faster and fairer deals personalised to you.