SocietyOne / The Best Guide to Loan Calculator Payment with SocietyOne

Personal Loans made easy

Credit made for you

The Best Guide to Loan Calculator Payment with SocietyOne

Award winning personal loans

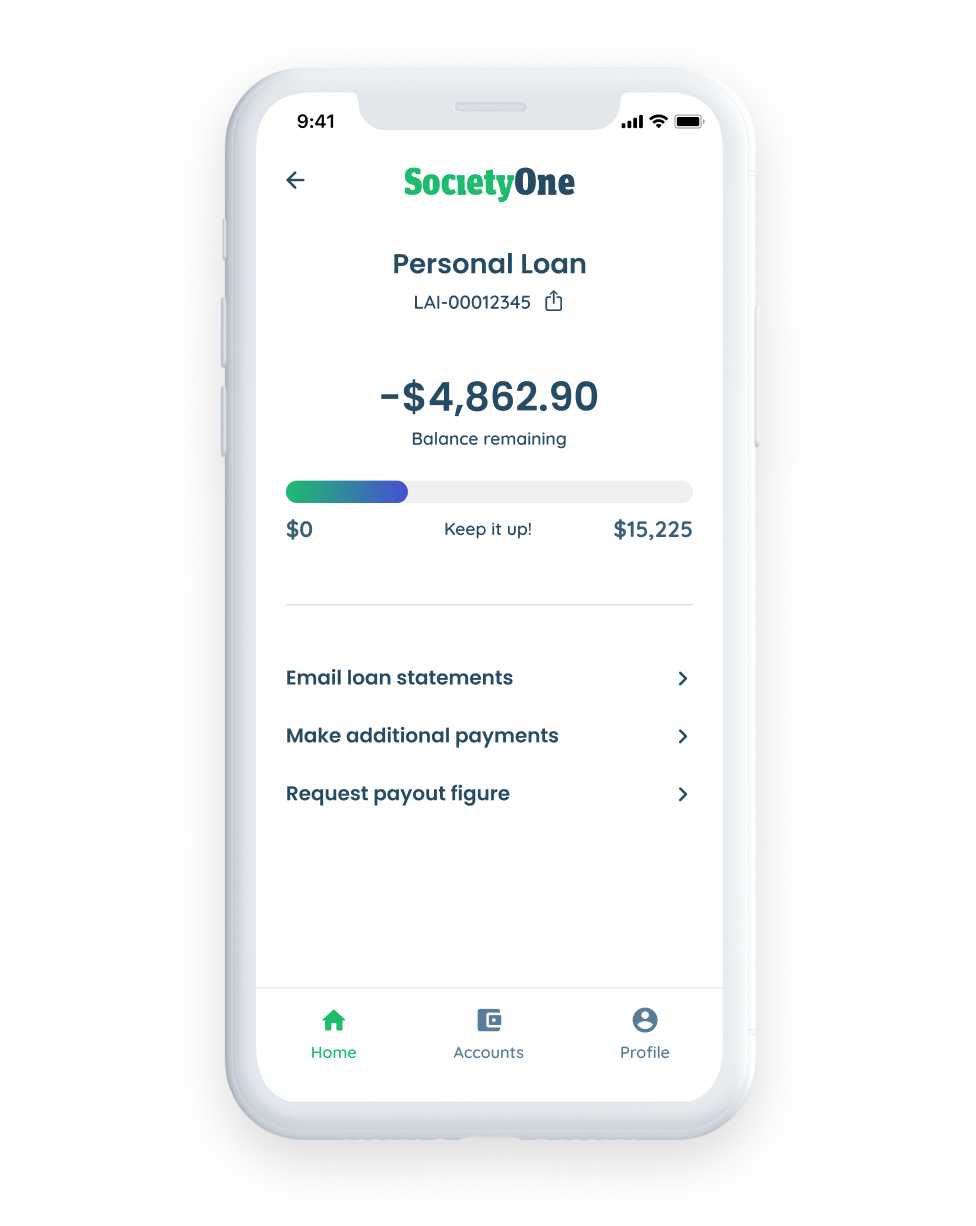

Easily calculate your loan repayments

Getting a personal loan with SocietyOne is quick and easy.

Navigating the complex world of finance can be daunting, but with a loan calculator payment overview, understanding loan terms becomes simpler. This tool does more than just crunch numbers; it helps clarify your financial path.

Not sure how it works? No worries. This guide will break down the basics of a loan calculator, payment of loans overview, and more.

Understanding Loan Calculators

What is a Loan Calculator?

A loan calculator is a digital tool that computes potential monthly payments for a specified loan amount. You can use it to determine how much you can afford to borrow based on your preferred monthly payment, which streamlines the borrowing process.

Comparing Before Committing

Taking out a loan without considering the costs could lead to higher payments than you expected. By making use of a loan calculator payment, you get a better perspective, ensuring the loan aligns with your financial situation. Several online platforms provide real-time rate quotes, facilitating direct comparisons tailored to your financial capacity.

At SocietyOne, we champion informed decisions, ensuring your financial experience is free of surprises.

Discover SocietyOne’s Offers

SocietyOne’s Secured and Unsecured Personal Loans

SocietyOne, Australia’s leading online lender, is part of the MONEYME Group, so you can count on us for faster, fairer deals. We offer both secured and unsecured personal loans. An unsecured loan provides flexibility without the need for collateral, allowing you to borrow with loan terms of two, three, or five years.

Secured loans, on the other hand, let you leverage your eligible asset, such as a car, to use as collateral. With this option, you can borrow larger loan amounts for terms up to two, three, five, or seven years.

Why Australians are Leaning Towards Personal Loans

Whether it’s the appeal of debt consolidation, the need to spruce up homes, the call of the open road with a new car, or other pressing requirements, quick and easy loans are the go-to solution for many. At SocietyOne, we understand this, which is why we provide not just a loan or access to a loan calculator payment solution but a bridge to aspirations.

With competitive interest rates and flexible loan terms, we turn dreams into tangible realities. Through tools like the interest rate calculator and loan payment estimate tool, potential borrowers get a snapshot of their loan affordability, aligning perfectly with SocietyOne’s principle of empowering informed decisions.

Frequently Asked Questions (FAQ)

How do I use a loan calculator to compare loan offers?

Getting a loan calculator payment scheme is straightforward and can provide valuable insights. Start by inputting the type of loan you want to take out, the amount you wish to borrow, the repayment schedule, and the loan term. Once you’ve gotten the calculations, you can compare the figures and see which loan offers the lowest interest rate and the smallest loan repayment.

Such tools are particularly beneficial for comparing loan offers, like those from SocietyOne. With our calculator, you can calculate your estimated interest rate based on your desired loan type (secured or unsecured), how often you’ll make repayments, the length of your loan term, and a self-assessment of your creditworthiness.

Our calculator also acts like a loan repayment planner since you’ll get an idea of how much your repayments may be if your personal loan application with us is approved.

Remember, with SocietyOne’s risk-based pricing, the better your unique credit profile, the lower your rate. To get a better idea, you can always check your credit rate score on the MONEYME app.

Through our Credit Score Tool, you can gauge your credit standing without negatively impacting it. If you see that your credit score is less than optimal, you can also check out some tips and tricks we provide on the app to help boost your credit.

Can I use a loan calculator for personal loans?

Absolutely! Whether you’re looking at personal loans, mortgages, or quick money loans, a loan calculator payment tool is very useful by helping you figure out how much your repayments are, how long you have to pay them for, and compare different offers to help you choose the most suitable loan for you.

At SocietyOne, we don’t just have a loan calculator that’s easy to use; we also have a 100% online application process for personal loans to make things convenient for you. This means you can apply from the comfort of your home, without the need for endless paperwork or visits to a branch. Our platform is designed for simplicity and speed, enabling you to get closer to loan approval.

How does the loan amount affect my monthly payments?

When you use a loan calculator, payment amounts will depend directly on your loan amount. In simple terms, the more you borrow, the higher your repayments will be. In addition to the loan principal, the interest rate and loan term also have an impact on your monthly payments.

Our personal loan calculator at SocietyOne allows you to adjust and play with different variables, such as loan payment schedule and interest rates, to let you determine the most suitable arrangement for you. We also offer both secured and unsecured loans and fortnightly and monthly payments, so you get more options.

SocietyOne: Revolutionising Personal Finance

Welcome to SocietyOne, Australia’s leading digital finance platform, offering both unsecured and secured fast personal loans. Whether you’re consolidating debt, revamping your home, or buying a car, we can help make it happen. Learn more with our free credit scores check or explore short term loans today.